Renters Insurance in and around Aurora

Aurora renters, State Farm has insurance for you, too

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

Protecting What You Own In Your Rental Home

It may feel like a lot to think through your sand volleyball league, keeping up with friends, family events, as well as deductibles and coverage options for renters insurance. State Farm offers no-nonsense assistance and unmatched coverage for your sound equipment, home gadgets and swing sets in your rented condo. When trouble knocks on your door, State Farm can help.

Aurora renters, State Farm has insurance for you, too

Renters insurance can help protect your belongings

Protect Your Home Sweet Rental Home

You may be skeptical that Renters insurance is really necessary, but what many renters don't know is that your landlord's insurance generally only covers the structure of the home. How difficult it would be to replace your belongings can be substantial. With State Farm's Renters insurance, you have a good neighbor who can help when unexpected mishaps occur.

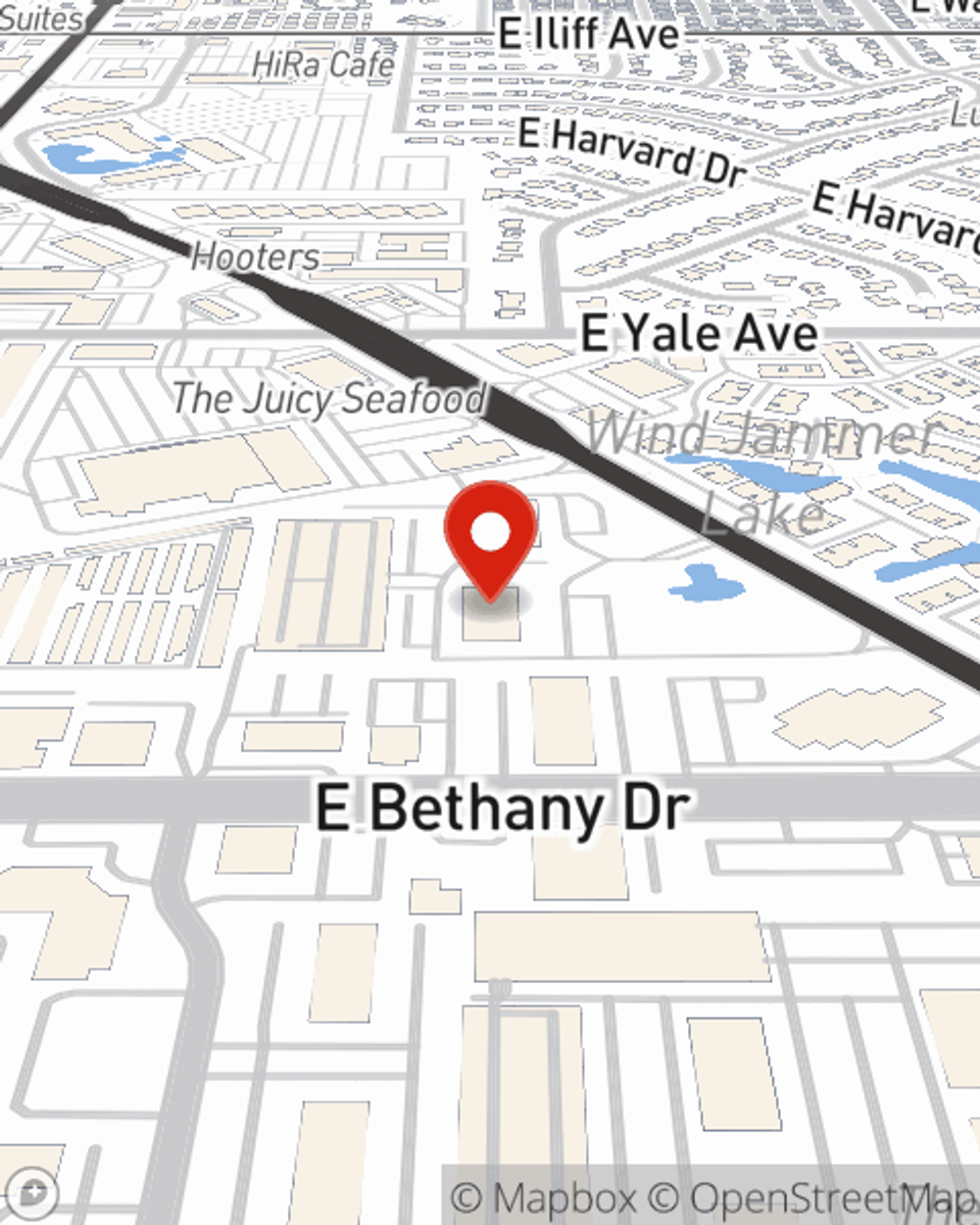

State Farm is a reliable provider of renters insurance in your neighborhood, Aurora. Get in touch with agent Tammy Hill today for help with all your renters insurance needs!

Have More Questions About Renters Insurance?

Call Tammy at (303) 399-2600 or visit our FAQ page.

Simple Insights®

The ins and outs of moving insurance

The ins and outs of moving insurance

Moving insurance can help you stay covered and protect your move. Before you purchase moving insurance, read these basics.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Simple Insights®

The ins and outs of moving insurance

The ins and outs of moving insurance

Moving insurance can help you stay covered and protect your move. Before you purchase moving insurance, read these basics.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.